Tax Brackets For 2025 Calculator. An income tax calculator is an online tool that helps individuals calculate the amount of income tax they will owe to the government based on their taxable income. Tax brackets divide income into ranges.

For example, if you earn $50,000, not all of it is taxed at the highest bracket rate you qualify for. To do income tax calculations, you can use the income tax calculator online, fill in your income and deductions to get your income tax amount in advance.

Us 2025 Tax Brackets Calculator Irina Leonora, Refer examples and tax slabs for easy calculation.

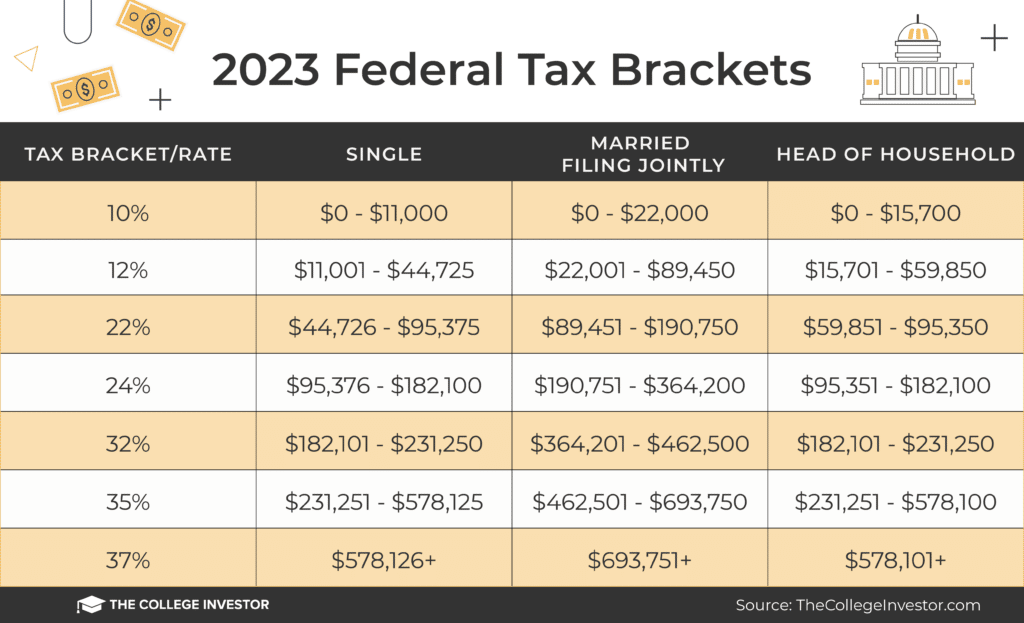

California Tax Brackets 2025 2025 Calculator Rhoda Elbertine, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Us 2025 Tax Brackets Calculator Irina Leonora, If your income is below the exemption limit, you don’t have to file income tax return.

New Australian Tax Brackets 2025 Ronald Johnson, Use tax deduction and liability calculator at paisabazaar.

Federal Tax Percentage 2025 Emily Avery, In tax year 2025, the maximum earned income tax credit amount will increase from $7,830 to $8,046 for qualifying taxpayers with three or more qualifying children.

Us Irs Tax Brackets 2025 Christian Murray, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

2025 Tax Brackets Calculator Maria Vaughan, Instead, portions of it fall into various tax brackets.

2025 Tax Brackets Married Filing Jointly Calculator Becki Carolan, Use our income tax calculator for india to find out your potential tax savings.